End-to-end AI-based automation for data extraction, verification, and validation is supported by the izCHQ solution having a high-speed processing engine.

Business Need

Cheque collections across multiple locations and transporting them to the bank locations/hubs result in higher operational costs. Next stage is to convert physical cheques to images using high-speed scanners at hubs.

These cheque images are processed (data extraction, verification, and approvals) manually through the bank cheque application. This cheque processing is time consuming and requires the utmost concentration of employees to read and process cheques to avoid manual errors. Additionally, cheque processing involves a high-value and high volume of cheque images, and is time bound exercise.

Finally, the entire process is complicated and have more manual work. Hence automation is the keep to solve the problems involved in manual check processing.

Solution

izCHQ solution uses AI technologies to extract, verify, and validate the data automatically from cheques. This solution requires very less manual intervention during processing resulting in higher STP. Though cheques are standardized still there are some variations in terms of information arranged on cheques, hence conventional OCR based solution fails to reduce manual intervention.

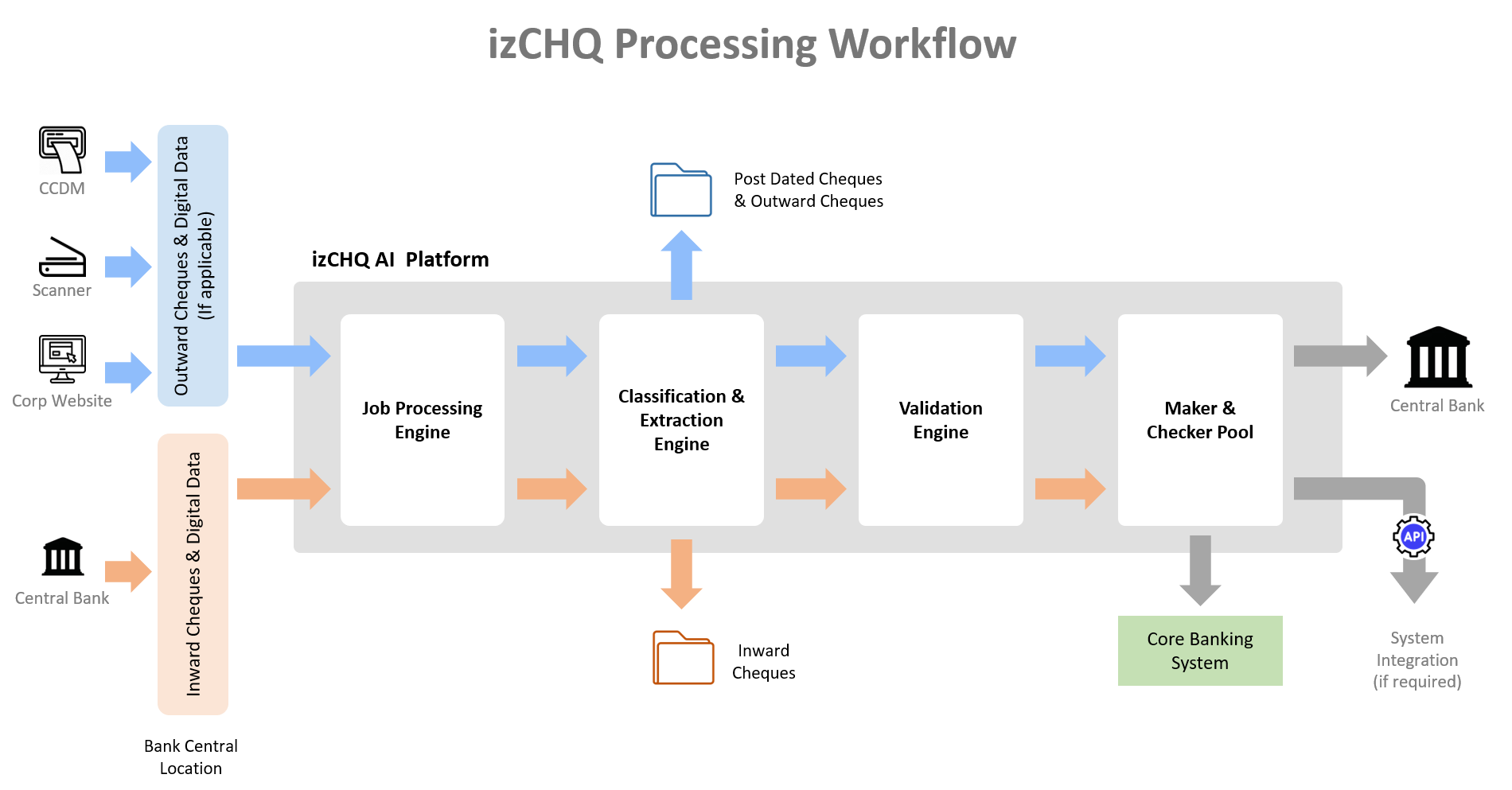

izCHQ is an end-to-end check/cheque processing automation solution for high speed clearing of checks/cheques. It uses high speed job processing engine to handle very high volume of cheques.

The solution also apply various criteria like LAR-CAR match, No PDC or stale cheque), and missing values, if any.

The application can be integrated to

- Multiple check scanners

- Core banking systems (Examples: Finacle/Flexcube/other)

- Existing ICCS / CTS systems of the banks for manual verification

- 3rd party applications through APIs

- Automatic signature verification (ASV) systems

izCHQ Benefits

Business Growth

Increased Time Window for Cheque Deposits

Accuracy

80 to 99.9% Key Value Extraction Accuracy

TAT

Faster Turn-Around-Time due to higher STP %

Productivity

4x-10x Productivity through Time Saving

izCHQ Solution Features

Data Extraction

Auto-extraction of data from cheque images

PDC & OC

Auto-identification of PDC and outward cheques

Amount Matching

Matching of the amount in figures and words

Identify Sign

Automatic signature verification

Fast Processing

Fast job processing engine for high volume documents